The Ultimate Protection

A complete asset and retirement fund protection under one product.

Covering you for both

Life insurance

and Long Term Care.

Who We are

We are a team of seasoned insurance brokers and industry experts with over 40 highly rated insurance companies. We are the pioneers in marketing life and health insurance products with over thousands of clients throughout the United States.

GREATEST FEARS IN RETIREMENT

Chronic Illness

The insured is unable to perform, without substantial assistance from another person, at least two of six Activities of Daily Living (ADLs):

- About 91% of older adults have at least one chronic condition, and 73% have at least two.

- 3.9 years: the average length of service for 50% of all long-term care insurance claims

- 5.000.000 Americans are living with Alzheimer’s …By 2050 it could rise to 16 million

Longevity Today

- 73% of respondents to a recent survey say serious health problems are their major worry about living to 100.

- 75% of heart attack victims survive at least three years.

- 75% of stroke victims survive the 1ST year.

- 50%+ will survive beyond 5 years.

Long Term Care Cost

- LTC is expensive, and the cost continues to grow.

- The average costs for long-term care in the United States in 2012 :

- $222/day for a semiprivate room in a nursing home

- $248/day for a private room in a nursing home

- $3,550/month for care in an assisted living facility (for a one-bedroom unit)

- $21/hour for a home health aide

- $20/hour for homemaker services

- $70/day for care in an adult day health care center.

- The average couple retiring at 65 can expect to pay $260,000 to cover their health care costs.

Living At Home

- When given the choice, many people choose to remain in their own homes while receiving care

- 52% HOME HEALTH CARE Professional provider giving care in the home.

- 28% NURSING HOME CARE 24-hour professional assistance.

- 20%COMMUNITY CARE Assisted living/ Adult day care.

Medical realities Today

- Approx. every 40 seconds, an American will have a heart attack

- Every 40 seconds someone in the United States has a stroke.

- Every 66 seconds someone develops Alzheimer’s Disease

Life's Unexpected Expenses

- $260,000 The average couple retiring at 65 can expect to pay to cover their health care costs in retirement

- About 80% of employer-based insurance incurs out-of-pocket deductibles. Surveys found the average annual deductible is $1,200.

Activities of Daily Living

-

- Bathing – Eating

Continence – Toileting

Dressing – Transferring- The insured is unable to perform, without substantial assistance from another person, at least two of six Activities of Daily Living (ADLs):

- The insured requires substantial supervision from threats to health and safety due to a severe cognitive impairment (similar to Alzheimer’s and other forms of irreversible dementia) that is measured by clinical evidence and standardized tests measuring:

- Short-term or long-term memory Orientation as to people, places or time, and Deductive or abstract reasoning

- Bathing – Eating

Be the Beneficiary of your own life insurance

-

- Long Term Care (LTC) coverage or Chronic Care Coverage is linked to a life insurance policy that provides benefits as well as a death benefit.

- 100% of the benefits for Long Term Care (LTC) or a death benefit is guaranteed to be paid out

%

of older adults have at least two chronic conditions

%

of older adults have at least one chronic condition

%

of all Americans 65 & older will need long term care

Why ultimate protection is better

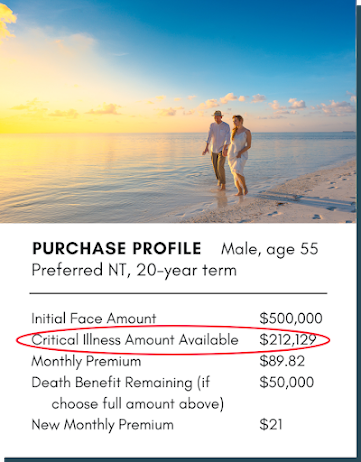

Learn How Robert Received $212,129 in Living Benefit Payout!

Five years after purchasing our term life insurance policy, Robert was diagnosed with Stage 3 prostate cancer and was unable to work for several months.

Robert exercised the Critical Illness Benefit to help pay medical bills, the mortgage, and other daily living expenses. He received $212,129 in cash with his $89.82 monthly premium.

Without money from this benefit, Robert would not have enough to cover many of these expenses.

Ultimate Protection

Nothing can devastate your retirement funds faster than paying out of pocket for a Long Term Care illness (such as a stroke, heart attack, dementia, or other illnesses). Most health plans, including Medicare, will not pay for the care or services required.